Here is a summary of what can happen if you get caught lying to Medicaid in New York City:

If you are caught lying to Medicaid, the most important thing to do is to not panic and not call the investigator. Instead, it makes sense to discuss the situation with an attorney. The consultation is free.

If you would like to discuss the letter with me personally, feel free to call me anytime at 212-233-1233. I am a private attorney. I don’t work for the government. Everything you say to me is confidential by law.

As a Medicaid fraud lawyer in New York City, I’ve helped many families out of difficult situations. My clients are typically accused of not reporting income or not reporting the man of the household on their application and recertification for welfare benefits. If you think you may be in that kind of situation, and you are being contacted by the Bureau of Fraud Investigation, then you may benefit from information I present in this article.

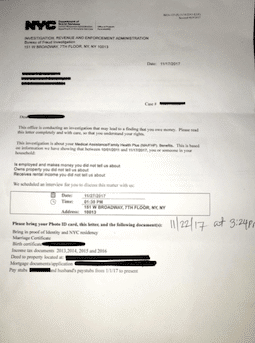

New York HRA DSS Bureau of Fraud Investigations catches up with people eventually. If you are caught lying to Medicaid about your income, you are likely to receive a letter asking you to meet with the investigators. If you get a letter from the investigator, speak to a Medicaid/SNAP fraud attorney right away.

Lying to Medicaid can be considered insurance fraud. A person is guilty of insurance fraud in the third degree when he commits a fraudulent insurance act and thereby wrongfully takes, obtains or withholds property with a value in excess of three thousand dollars. Insurance fraud in the third degree is a class D felony. [1]

Getting caught can mean going to jail for up to seven years. For a class D felony, the maximum prison term shall be fixed by the court, and shall not exceed seven years; [2] The minimum period shall be fixed by the court and specified in the sentence and shall be not less than one year nor more than one-third of the maximum term imposed. [3]

Many people who get caught lying to Medicaid have extenuating circumstances. Some people did not understand the Medicaid application. Some people were told by insurance agents that it’s ok to fill out the application that way. Some people thought that for whatever reason, they don’t have to list their husband and his Medicaid application. This is something that a judge may or may not consider to be extenuating circumstances in applying the “nature and circumstances” clause to impose a sentence that is less than one year.

If the court, having regard to the nature and circumstances of the crime and to the history and character of the defendant, is of the opinion that a sentence of imprisonment is necessary but that it would be unduly harsh, the court may impose a definite sentence of imprisonment and fix a term of one year or less. [4]

What is the penalty for Medicaid or SNAP fraud? New York Penal Law 155 describes the sentencing guidelines for someone committing Medicaid or SNAP fraud. The sentence depends on the total amount received. For most people, the amount received from Medicaid or SNAP is between over $3,000 and under $50,000, which according to the guidelines can carry a sentence of up to seven years in jail.

| Amount Received | Degre of Welfare Fraud | Section of Penal Code | Felony Class | Penalty |

|---|---|---|---|---|

| In excess of $1,000 but not more than $3,000 | Fourth Degree | PL 158.10 | Class E Felony | up to 4 years in prison |

| In excess of $3,000 but not greater than $50,000 | Third Degree | PL 158.15 | Class D Felony | up to 7 years in prison |

| In excess of $50,000 but is not more than $1 million | Second Degree | PL 158.20 | Class C Felony | up to 15 years in prison |

| In excess of $1 million | First Degree | PL 158.25 | Class B Felony | up to 25 years in prison |

Restitution. If you are prosecuted by the District Attorney’s office and get sentenced, then you will not only have to go to jail but would also have to pay back the benefits received as restitution.

One of the things that can happen when you get caught lying to Medicaid is you can have a permanent record of a fraud felony. This can be a substantial problem in obtaining employment and maintaining or receiving a professional license. Most companies would not want to hire a person who has been convicted of fraud.

It should come as no surprise that they will cut off your benefits as soon as you get caught lying to Medicaid since you did not qualify for the benefits in the first place.

There could come a time in your life when you would genuinely need Medicaid and will qualify for it. But because of your record of lying to Medicaid, they may have a permanent disqualification on your record, meaning that you will be barred for life from receiving Medicaid for life.

Not only can Medicaid refer your case to the District Attorney’s office to file criminal charges, but they can also sue you and obtain a judgment against you. Once Medicaid obtains the judgment, they can use it to garnish your paycheck, garnish your bank account, seize your assets such as vehicles and real estate and seize your tax refunds. They will use the power of the government and the courts to recoup the money they’ve spent on your insurance premium payments before you got caught lying to Medicaid.

The first step you should take is this: speak with an experienced Medicaid fraud attorney. Do not take the chance of meeting with the investigators on your own. They are trained to obtain information against you that they can later use to their advantage in criminal prosecution and in civil court.

We at the Law Offices of Albert Goodwin are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected] .

Law Offices of

Albert Goodwin, PLLC

31 W 34 Str, Suite 7058

New York, NY 10001

Albert Goodwin, Esq. is a licenced New York attorney with over 15 years of courtroom experience. His extensive knowledge and expertise make him well-qualified to write authoritative articles on a wide range of legal topics.

Prior results do not guarantee a similar outcome

This website contains general information and may not apply to your case.

This website does not form an attorney-client relationship.

We are not your attorney, unless you hired us.

© Copyright 2008-Current, Law Offices of Albert Goodwin, PLLC, Albert Goodwin, Esq.